The company expects to increase the revenue of $ 3M per year from this equipment, it also increases the operating expense of around $ 500,000 per year (exclude depreciation). Accept the project only if its ARR is equal to or greater than the required accounting rate of return. Further management uses a guideline such as if the accounting rate of return is more significant than their required quality, then the project might be accepted else not. Based on the below information, you are required to calculate the accounting rate of return, assuming a 20% tax rate.

Accounting Rate of Return (ARR) Formula

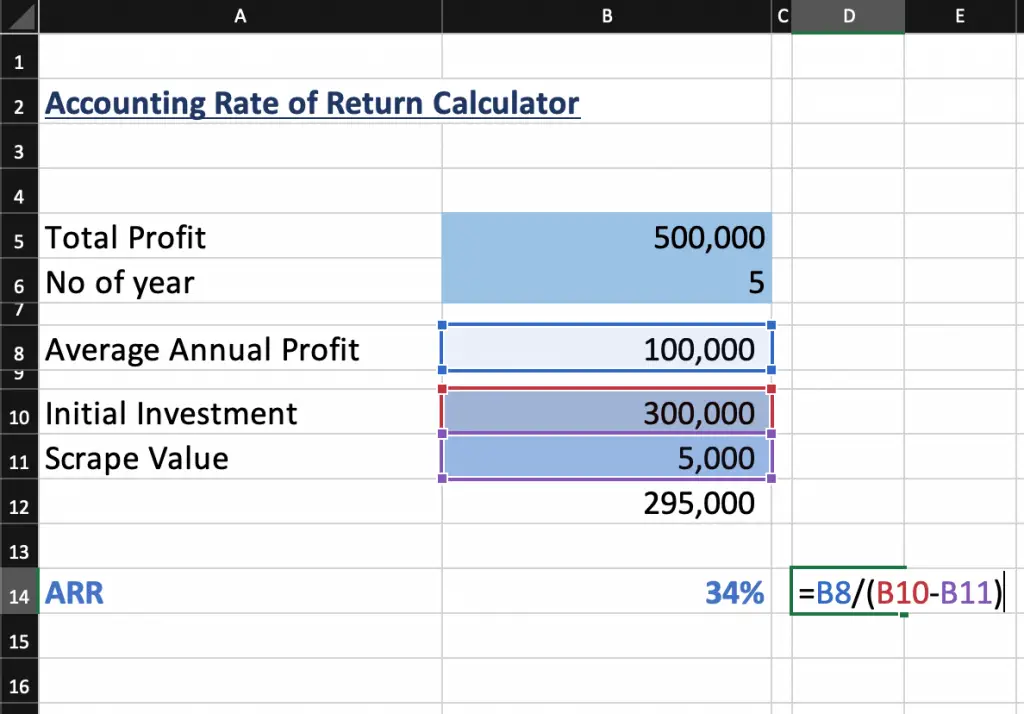

Using the ARR calculator can also help to validate your manual account calculations. Accounting Rate of Return, shortly referred to as ARR, is the percentage of average accounting profit earned from an investment in comparison with the average accounting value of investment over the period. For example, if your business needs to decide whether to continue with a particular investment, whether it’s a project or an acquisition, an ARR calculation can help to determine whether going ahead is the right move.

Ease of calculation

- In today’s fast-paced corporate world, using technology to expedite financial procedures and make better decisions is critical.

- The RRR can vary between investors as they each have a different tolerance for risk.

- The Accounting Rate of Return (ARR) Calculator uses several accounting formulas to provide visability of how each financial figure is calculated.

- For example, if your business needs to decide whether to continue with a particular investment, whether it’s a project or an acquisition, an ARR calculation can help to determine whether going ahead is the right move.

- The estimated life of the machine is of 15 years, and it shall have a $500,000 salvage value.

The decision rule argues that a firm should choose the project with the highest accounting rate of return when given a choice between several projects to invest in. However, the formula doesn’t take the cash flow of a project or investment into account. It should therefore always be used alongside other metrics to get a more rounded and accurate picture. The time value of money is the main concept of the discounted cash flow model, which better determines the value of an investment as it seeks to determine the present value of future cash flows.

Example: simple rate of return method with salvage value

This is a solid tool for evaluating financial performance and it can be applied across multiple industries and businesses that take on projects with varying degrees of risk. The accounting rate of return is one of the most common tools used to determine an investment’s profitability. Accounting rates are used in tons of different locations, from analyzing investments to determining the profitability of different investments. The RRR can vary between investors as they each have a different tolerance for risk. For example, a risk-averse investor requires a higher rate of return to compensate for any risk from the investment.

Read on as we take a look at the formula, what it is useful for, and give you an example of an ARR calculation in action. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Investment evaluation, capital budgeting, and financial analysis are all areas where ARR has a strong foundation. Its adaptability makes it useful for a wide range of applications, including assessing the economic profitability of projects, benchmarking performance, and improving resource allocation. The ARR is the annual percentage return from an investment based on its initial outlay.

Here we are not given annual revenue directly either directly yearly expenses and hence we shall calculate them per the below table. We are given annual revenue, which is $900,000, but we need to work out yearly expenses. The ARR calculator makes your Accounting Rate of Return calculations easier. You just have to enter details as defined below into the calculator to get the ARR on any particular project running in your company. The initial cost of the project shall be $100 million comprising $60 million for capital expenditure and $40 million for working capital requirements.

This indicates that for every $1 invested in the equipment, the corporation can anticipate to earn a 20 cent yearly return relative to the initial expenditure. In this blog, we delve into the intricacies of ARR using examples, understand the key components of the ARR formula, investigate its pros and cons, and highlight its importance in financial decision-making. The Accounting Rate of Return can be used to measure how well a project or investment does in terms of book profit.

It also allows managers and investors to calculate the potential profitability of a project or asset. It is a very handy decision-making tool due to the fact that it is so easy to use for financial planning. The vertical analysis common size analysis explained calculates the return or ratio that may be anticipated during the lifespan of a project or asset by dividing the asset’s average income by the company’s initial expenditure. The present value of money and cash flows, which are often crucial components of sustaining a firm, are not taken into account by ARR. The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. ARR does not include the present value of future cash flows generated by a project.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Some limitations include the Accounting Rate of Returns not taking into account dividends or other sources of finance.